The Rise of Index-tracking

As documented at length in our preceding report, "Under new management: Share ownership and UK asset manager capitalism", the shareholder structure has undergone several transformations over the past several decades. Most recently, shareholders’ interests became increasingly aligned with managers’ via the implementation of new executive compensation models where managers were vested with significant shareholdings. This coincided with a gradually increased return of free cash flow to shareholders rather than to reinvestment, instead using increased debt to finance new investment. The "control function of debt" focused managers on cost reduction and shareholder value maximisation while requiring them to submit their spending plans to the scrutiny of their sources of finance.

From the 1990s onwards, political economists began to notice the increasing concentration of ownership among a relatively small number of active mutual funds who held significant stakes in a surprisingly large number of corporations. Gerald F. Davis defined the "new finance capitalism" as characterised by “networks of concentrated yet liquid ownership without control.” But as previous Common Wealth research has noted, in the years since the Global Financial Crisis, this concentration has intensified still to an unprecedented degree. A key distinction from preceding waves of concentration, however, has been the shift away from the active mutual funds exemplified by Fidelity, and towards an even smaller number of passively managed "index mutual funds" and exchange-traded funds (ETFs). (The main difference between passive MFs and ETFs is intra-day liquidity, with the former being tradable only at the end of each day. For our purposes we therefore treat them as the same category.)

For these funds, portfolio selection ceases to be a matter of identifying growth opportunities and exiting weak positions and instead becomes simply a matter of replicating an existing index. Passive funds therefore hold a given equity permanently, or rather for as long as it is listed on that index. This amounts to an illiquid holding of what are otherwise perfectly liquid assets. The indices, meanwhile, can be a generic listing of all the largest companies such as the FTSE 100 or S&P 500, or can be industry-specific, or, increasingly, based on ESG assessments.

Passive funds generate revenue in the form of client fees based on the size of their "assets under management" (AUM), usually in the region of 0.1%. Their modus operandi is therefore to expand their AUM. This in turn means boosting the value of existing assets as well as bringing in new customer AUM, which means minimising their costs, favouring economies of scale.

Prior to the Global Finance Crisis, investors were willing to tolerate high fees during the boom under the widely-held belief that it could be justified by market-beating returns. But in the aftermath, it has become increasingly difficult to consistently "beat the market" [1] and so, investors have turned increasingly to passive funds, content to achieve benchmark market returns at as low a cost as possible. [2] Meanwhile, the post-crisis scramble for stability has witnessed the mergers of various large financial institutions and a host of post-crisis regulatory measures have limited banks’ role in investment management.

Implications for Corporate Behaviour

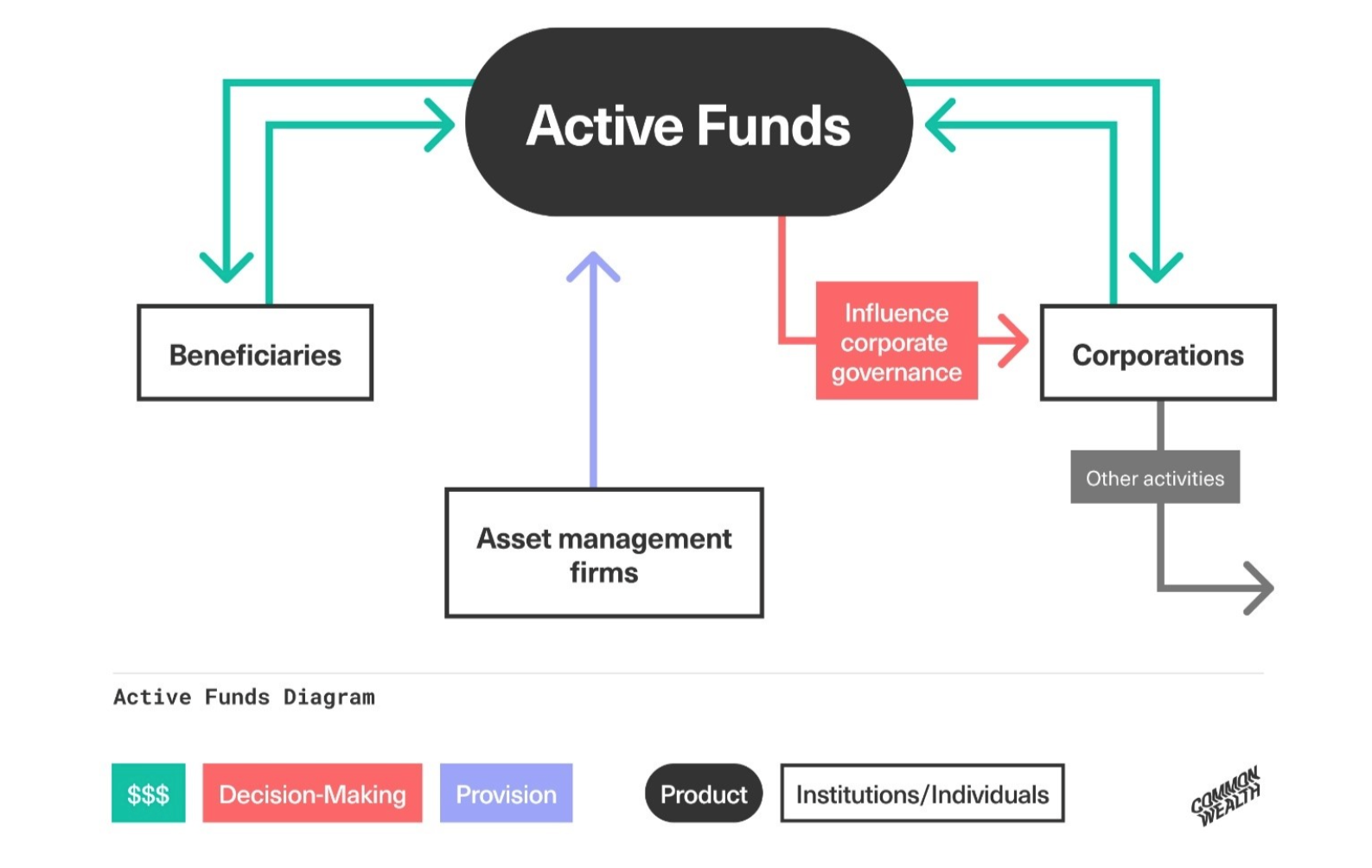

Shareholders traditionally have different means of influencing corporate decision-making, which in practice vary according to regulation, cost-effectiveness, and incentives.

- The simplest is exit, i.e., selling one’s stake. Managers are disciplined by the downward pressure that large selloffs can exert.

- A second method, voice, is to engage directly with managers on an ongoing basis, on matters of “business oversight and strategy.”

- A third is (proxy) voting power during AGMs. Block-holders with more than 5% of shares are generally considered highly influential.

What, then, are the implications of the rise of passive funds with respect to these means of influence?

[.green]Exit[.green], or at least discretionary exit, is by definition foreclosed. While financial campaigners have argued that there are no legal requirements blocking fund managers from deviating from indices, industry practice and accepted commonsense is that discretionary exit in passive funds is a violation of the fund’s operating framework. Instead, with the rise of large and influential indices, corporations’ primary worry becomes exclusion from entire indices or segments, for instance based on their activities (thermal coal mining), size, or another characteristic.

[.green]Voice[.green] is more ambiguous. Its influence over corporate managers is simultaneously bolstered by the concentration of voting power behind it and weakened by the absence of a credible threat of exit. The Big Three themselves have been eager to emphasise that passive investment need not mean passive governance and that the impossibility of active exit simply means a pivot in the “nature of engagement” towards “constructive activism.” Some have pointed for reassurance to the corporate stewardship and governance teams that the Big Three and other firms have established and expanded in order to monitor and police portfolio companies. Yet one study estimated that the Big Three’s combined investment in these stewardship teams come to less than 0.2% of the fees they generate from those assets, while the proportion of portfolio companies receiving any private engagement at all in a given year is vanishingly small. This conforms to the theory that a passive fund manager’s imperative to minimise costs will invariably constrain their appetite to engage in-depth with the governance of a given corporation within a large, diversified portfolio.

[.green]Voting[.green] is the most uncomplicated lever of power available to passive managers. While the Big Three’s holdings of corporations are often spread diffusely across multiple funds, the similarity of their interests means that together they generally represent a united block of investors on key votes. Each of the Big Three show a huge degree of internal agreement across their many funds when it comes to AGM proxy votes: BlackRock funds voted unanimously in all but 18 of every 100,000 votes, compared to e.g., 3,144 in the case of the much more active manager Fidelity.

As "permanent" owners, passive investors are also able to act as “patient capital,” with less of a financial interest than others in short-term extraction from their portfolio companies. Far more than active funds, the Big Three tend overwhelmingly to side with management on issues such as executive pay, stock buybacks and M&As, and disproportionately reject proposals tabled by activist shareholders. Insofar as the financial engineering proposed by activist shareholders often serves to juice their short-term returns before they exit, voting against them looks like welcome far-sightedness on the part of the passive giants. But its scope appears very limited, with the Big Three frequently voting down proposals relating to ESG and climate action. It would be profoundly naive to assume that the notion of "long-term shareholder value" has fortuitously fallen into perfect harmony with the demands of our planet and society more broadly.

A further question is raised about the hidden infrastructural power of opaque index providers to whom stock selection is effectively – and every increasingly – delegated. Upcoming Common Wealth briefings and reports will explore these questions in greater detail. For now, this analysis provides a glimpse into the high-level ownership trends as they pertain to the UK.

Passive Investment in the UK: Growth trends

Using data from Thomson-Reuters’ Refinitiv Lipper database, this analysis focuses on all equity-based funds for sale in the UK that have at any point in the last 20 years held an equity stake in a FTSE All Share firm (the index covering nearly all market capitalisation on the London Stock Exchange). These funds will also hold stakes in firms listed outside the UK.

The figures below track the number of such funds starting from the end of 2003, splitting between actively and passively managed. In the absence of data on these funds’ AUM, we instead measure their total net assets (TNA), i.e. the value of the portfolio’s underlying holdings net of expenses. This tells a similar story: of a passive sector that begins to gather discernible momentum after the GFC before attaining extraordinary growth from mid-2017 onwards at the visible expense of its active counterpart, considerably closing the gap between them. (Both segments have benefited in similar magnitude from the emergency measures of central banks in response to the onset of the Covid-19 crisis.) Note that this metric does not distinguish between fresh flows of clients’ money into or out of the funds versus changes in the value of funds’ existing assets.

In the period immediately after the Global Financial Crisis, this relative growth was driven by a proliferation in the number of passively managed funds. But in the last five years their average size has raced ahead of active funds, in keeping with the limited degree of differentiation to be expected of funds designed merely to replicate the performance of a limited number of indices. Interestingly, this spike in the average TNA of passive funds appears to have been relatively broad-based at the fund level, rather than driven by small concentration of funds.

The figure below further breaks down the data above into mutual funds and exchanged-traded funds (ETFs). ETFs (whose shares can be traded on exchanges like a company’s stock) are overwhelmingly passive, while mutual funds (whose shares are bought directly from managers offering them) can be either passive over actively managed. The vast majority of the actively managed sector is comprised of mutual funds.

ETFs vastly outnumber passive mutual funds and have just in the last two years overtaken them in total TNA. While both are growing at the same absolute pace, ETFs remain similar in individual size to active mutual funds, with passive mutuals essentially accounting for all of the difference in average TNA between active and passive funds generally.

Ownership of FTSE Companies

Here we restrict our attention to FTSE All Share companies, and the entire universe of funds that hold reported stakes in them. This includes mixed funds that invest in asset classes other than equities, as well as funds that are not for sale in the UK. Note that an estimated 2/3 of sales represented on the FTSE All Share is generated from abroad. But since we are concerned with the governance implications of passive ownership, it suffices for us to focus on where the firms are listed rather than where their activities extend.

One third of the aggregate market cap of the FTSE All Share index, is now accounted for by the holdings of funds reporting to the Lipper fund database. This is up from just 15% in 2009. The residual is accounted for by owners who do not show up in the Refinitiv database, such as small holdings by wealthy individuals, as well as direct holdings by other investors and firms.

While 12% of the reported shareholdings of FTSE 100 companies is attributed unidentified Lipper funds, index-trackers now comprise a third of these holdings up from just 12% in 2008. Active funds’ share of reported holdings has meanwhile fallen from 75% to just over 50% over the same period. Unsurprisingly, this shift is less developed in the smaller cap indices like the FTSE 250 and the FTSE Small Cap, but the direction of travel is the same. Moreover this trend shows no sign of plateauing in the near future, and the conditions that made it possible remain intact.

Concluding Remarks

The analysis above confirms that in the UK, as in the US and elsewhere, ownership of our largest corporations is being increasingly consolidated in a small number of passive funds. This amounts to an extraordinary concentration of corporate power within the hands of a few asset management firms and the companies providing the indices that these funds track.

How do passive funds and active firms differ in their holdings in key sectors such as oil and gas? At what rates do they divest from fossil fuel companies and divert investment to renewable energy? And where they do hold stakes, how do they use their influence in practice?

These questions will be explored in a series of upcoming Common Wealth briefings and reports. How these firms choose to wield their growing power will prove decisive to whether we overcome the multiple crises we are facing, not least for a fair transition to a zero-carbon future. The implications for the governance of our economic resources are profound and cannot afford to be ignored.