Explainer

Explainer: What's the Deal with Asset Management

Date

Authors

This research is published in collaboration with the following organisations:

No items found.

Explainer

Explainer: What's the Deal with Asset Management

Executive Summary

Over the course of April 2022, Elon Musk and Twitter entered a drawn-out battle over ownership of the company. Faced with the threat of losing their position, the company’s largest existing shareholder, Vanguard, increased its stake from 8.4% to over 10.3%. Elon Musk eventually agreed a deal with Twitter to purchase the company in its entirety for approximately $44 billion, though the deal has yet to be enacted (and faces several barriers to its success). Even for Elon Musk, the world’s richest man, this is a phenomenally large investment. For Vanguard, to have done the same would be virtually trivial. With over $7 trillion in assets, Vanguard could have bought Twitter at the same cost more than 100 times over, and still had trillions to spare. So why did their ownership stake hardly raise eyebrows?

The $20 trillion titans

[.green]Today, asset managers are the dominant owners of corporations and other assets throughout the global economy…[.green]

Vanguard is the second largest asset management firm in the world, at the top of a cohort of incredibly and increasingly powerful investment institutions whose investments span the entire global economy. Rather than investing their own money, asset managers invest on behalf of beneficiaries like pension holders, foundations, or individuals with savings. However, despite making investments using other people’s money, asset managers remain the legal owners of the securities they purchase, from stocks and corporate bonds to commodities and real estate. This gives them many of the rights that come with owning these assets, such as voting rights at corporations. Over the past few decades, the asset management industry has both exploded in size and become hugely concentrated, such that today a small cohort of enormous asset management firms dominates both the industry itself, and ownership of assets in the global economy.

Together, Vanguard and Blackrock, the world’s largest asset management firm, control close to $20 trillion. The assets under their control thus represent nearly a fifth of the entire global asset management industry, which is comprised of thousands of firms worldwide managing $100 trillion in assets. To put that in context, it is also enough to own all the shares in every company listed on the entire London Stock Exchange – including BP, Shell, AstraZeneca and a range of other household corporate names – more than three times over.

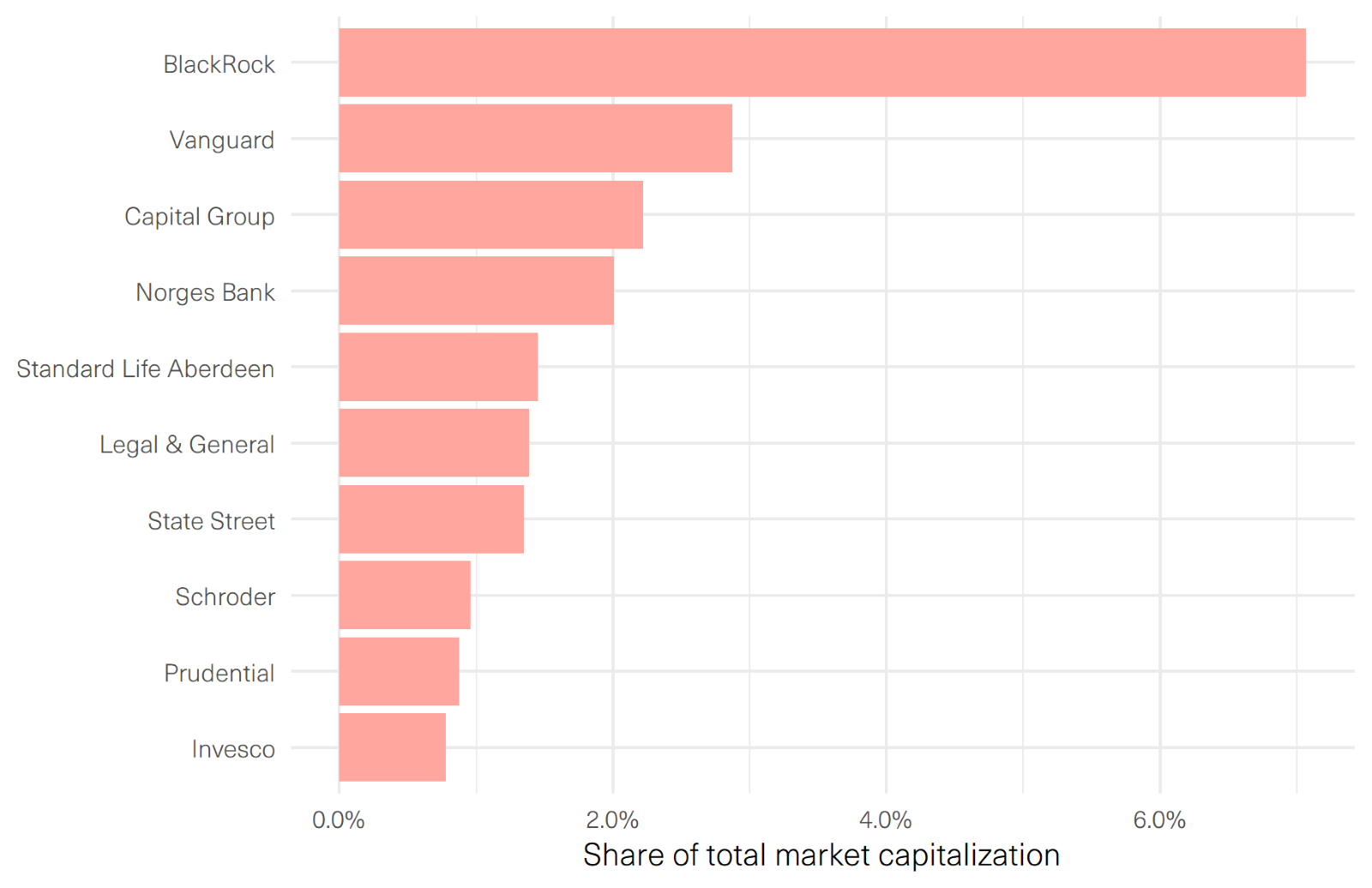

In practice, BlackRock and Vanguard do not buy up entire companies. Instead, their business model is based on distributing their investments “universally” – this means that across the entire global economy, spanning every region, industry, and type of asset, from stocks and bonds to real estate and commodities. Moreover, because of their size, they tend to have relatively large investments across this entire universe. Thus, Vanguard taking a 10% stake in Twitter wasn’t even exceptional. With respect to owning corporations, in the UK, BlackRock and Vanguard together control 10% of all shares in the average FTSE350 company (the 350 largest shares on the London Stock Exchange), while in the US they, in combination with State Street (together often called the “Big Three”), collectively control over 20% of the average S&P500 firm (the 500 largest US corporations, spanning everything from Amazon and Pfizer to Exxon and Apple).

[.img-caption][.img-caption-header]Figure 1 Top asset managers dominate ownership of the FTSE350[.img-caption-header][.img-caption-text]Source: Adrienne Buller & Benjamin Braun (2021) "Under New Management: Share ownership and the growth of UK asset manager capitalism". Common Wealth[.img-caption-text][.img-caption]

Asset manager capitalism (AMC)

[.green]…which makes them motivated by an overriding drive: to increase the value of the pool of assets they manage.[.green]

At face value, this may not sound overwhelmingly large. In practice, because many shareholders don’t participate in corporations’ voting processes (which take place at Annual General Meetings, or AGMs) it is enough to often give this trio of asset managers effective veto power in these votes, and by extension enormous influence over the actions taken by the world’s most critical corporations, from the oil majors to Big Tech and Pharma. What do they do with this power? And most importantly, what are their motivations?

For the first question, the evidence suggests: not much. According to research from civil society groups and the companies’ own filings, the biggest investment firms vote overwhelmingly in line with corporate management on decisions ranging from executive pay packages to supply chain deforestation and climate targets. In the 2020-2021 corporate AGM season, BlackRock disclosed that it followed corporate management’s vote on 88% of all resolutions. Research from ShareAction suggests that in 17/102 climate resolutions in 2020, a vote in favour from any one of the Big Three firms could have enabled the resolution to pass. In general, then, the Big Three asset managers are not using their enormous voting privilege as shareholders to drive change on key issues like the climate crisis or labour rights.

Why not? Academic Benjamin Braun has articulated an essential framework for understanding the motivations of these companies, based on the nature of a historically novel ownership regime: asset manager capitalism.

To recap, with respect to their business model, the biggest asset managers are:

[.num-list][.num-list-num]1[.num-list-num][.num-list-text]Universal: they have investments across the whole economy.[.num-list-text][.num-list]

[.num-list][.num-list-num]2[.num-list-num][.num-list-text](Relatively)Strong: their investments tend to be comparatively large relative to the average shareholder (e.g., 5-10%).[.num-list-text][.num-list]

[.num-list][.num-list-num]3[.num-list-num][.num-list-text]Fee-based: their entire source of profit is based on charging fees to beneficiaries as a percentage of the size of the asset pool under their management.[.num-list-text][.num-list]

Thus, unlike an individual investor who may have a small portfolio with a handful of investments and is therefore acutely interested in the actions and performance of those specific firms, large asset management firms are not interested in the behaviour of any one company or even industry within which they are invested. Instead, their focus is on the performance of the entire universe to which they are exposed – that is, the majority of the global economy. And, because their business model is based on the size of the asset pool they manage, this means their overriding motivation for this universal portfolio is securing its aggregate expansion, whether by bringing in new assets or by increasing the prices of the assets under their management.

Why does this matter?

[.green]Under Asset Manager Capitalism (AMC), the justifications for the huge privileges and protections afforded to shareholders are increasingly untenable…[.green]

Shareholders are granted a potent blend of privileges and protections in the corporation, to the exclusion of other stakeholders like workers, affected communities, or societal concerns such as sustainability and inequality. Primarily, these include:

[.num-list][.num-list-num]1[.num-list-num][.num-list-text]Governance rights: the right to vote at corporate AGMs and shape corporate plans.[.num-list-text][.num-list]

[.num-list][.num-list-num]2[.num-list-num][.num-list-text]Income rights: entitlement to payouts from the corporation such as dividends.[.num-list-text][.num-list]

[.num-list][.num-list-num]3[.num-list-num][.num-list-text]Limited liability protections: if a corporation folds, shareholders can only lose as much as the value of their investment and are not liable for any other costs like outstanding debts, unpaid wages, or fines and damages from misconduct. [.num-list-text][.num-list]

This bundle of rights and protections has been based on the idea that shareholders are weak relative to other parties (like corporate insiders); have a strong interest in the performance and actions of each company in which they invest; bear financial risks in supporting the corporation, offering investment with no guarantee of a return. It’s on these assumptions that, over the past several decades, corporations have been organised around the idea of “maximising shareholder value”, with consistently rising shareholder payouts in the form of dividends and stock buybacks and declining investment in the things we urgently need, like more sustainable methods of production or liveable wages for workers.

[.img-caption][.img-caption-header]Figure 2 Shareholder payouts versus productive investment in the FTSE350[.img-caption-header][.img-caption-text]Source: Adrienne Buller and Benjamin Braun (2021) “Under new management: share ownership and the growth of UK asset manager capitalism”, Common Wealth[.img-caption-text][.img-caption]

.png)

The trouble is that the assumptions used to justify shareholder primacy no longer hold water (if they ever did). Today’s shareholders are overwhelmingly asset management firms whose interest is little more than the aggregate growth of their portfolio value. Despite this, these shareholder rights remain intact. Last year, BlackRock participated in some 160,000 votes at over 17,000 companies, voting broadly in line with corporate management and doing little to drive action on the climate crisis despite their outward campaign to be seen as a climate leader. Moreover, when it comes to the question of who actually bears risk in the economy, shareholders are protected by the powers of the state time and again through no-strings-attached bailouts and central bank interventions that keep prices high, as we’ve witnessed throughout the pandemic. When companies do fail or create egregious harms, for instance through mass layoffs or soaring carbon emissions, it’s the public – not shareholders or asset management firms – who end up picking up the tab.

Building a democratic economy

[.green]The result is a system of investment that doesn’t work for people or planet. It’s time to change that.[.green]

Today’s financial system looks radically different than it did in the 1980s, when newly empowered neoliberal politicians and institutions began to champion the idea of a “shareholding democracy”. Rather than creating an economy in which everyone has a stake and a say, and in which investment is directed democratically toward meeting urgent societal needs and challenges, we have an investment system oriented toward the demands of wealthy asset owners and under the growing influence of a bloc of asset management intermediaries structurally disinterested in the actions of the corporations they own. Elon Musk might control two major corporations, but together these vast firms call the shots at thousands.

The rise of asset manager capitalism as a new regime of investment, ownership, and corporate governance represents a fundamental shift in power in the global economy, and a new challenge to economic democracy. At the same time, the systemic importance of just a few actors opens up the possibility for truly transformative policy interventions with systemic impact. Our final report will map and examine a range of new ideas for harnessing the power of ownership to build a more equal, democratic, and innately sustainable economy and future.

Full Text

Explainer: What's the Deal with Asset Management

Footnotes