Low participation, low investment

[.img-caption][.img-caption-header]Figure 2 Business investment lags behind the OECD average[.img-caption-header][.img-caption-text]Source: World Bank[.img-caption-text][.img-caption]

.png)

The UK economy is as much an outlier in terms of low investment as it is for weak participation. Indeed, it is the joint second worst performing OECD member for gross fixed capital formation (a measure of investment) as a share of GDP; only Greece has lower rates of investment. [13] Making cross-country comparisons of investment is difficult owing to the cyclical nature of investment, the connection between investment and sectoral composition and varying levels of public expenditure. However, it is reasonable to infer that pressure to distribute private sector earnings to shareholders — often to the detriment of investment in production — is higher when a company’s priority is rewarding external investors, and when stakeholders with longer-term horizons, such as employees, are denied voice. [14] This inference is supported by firm level analysis of the German model of governance, which mandates worker representation on supervisory boards for companies with over 2000 employees outside the coal, iron and steel industries. Within this cohort, investment is lower at firms without co-determined governance. [15]

The UK is a model of the consequences of undemocratic company governance. A combination of corporate governance rules and pressure from financial markets to “disgorge the cash” have led companies to prioritise the distribution of their profits in the form of dividends and share buybacks, over increasing investment. [16] For example, in 2020, despite the effects of the pandemic, aggregate dividend payouts by FTSE 350 companies represented around 90 per cent of aggregate pre-tax profit. [17] Buybacks by UK firms reached over £55 billion in 2022, with Common Wealth and IPPR analysis finding that share repurchases by FTSE companies were twice as high last year as their pre-pandemic peak in 2018. [18] The exceptional level of shareholder payouts cements a two-decade trend in the UK economy that has seen the distribution of profits tilt further toward shareholders, with dividends rising six times faster than real wages between 2000 and 2019 while business investment remains chronically low. [19] Figure 3 makes this trend clear, demonstrating more than two decades of decline in business investment in the FTSE350 that has occurred alongside significant increases in dividends as a share of profit.

[.img-caption][.img-caption-header]Figure 3 Investment is falling in the FTSE350 while shareholder payouts rise[.img-caption-header][.img-caption-text]Source: Refinitiv[.img-caption-text][.img-caption-text]Note: Data shows the 121 firms in the index throughout the full period. Capex/Depreciation & Amortization is a measure of investment[.img-caption-text][.img-caption]

[.img-caption][.img-caption-header]Figure 4 Business expenditure on R&D as a percentage of GDP is correlated with economic participation across Europe[.img-caption-header][.img-caption-text]Source: OECD[.img-caption-text][.img-caption-text]Note: Bulgaria, Cyprus, Croatia, Malta and Romania have been excluded due to lack of data[.img-caption-text][.img-caption]

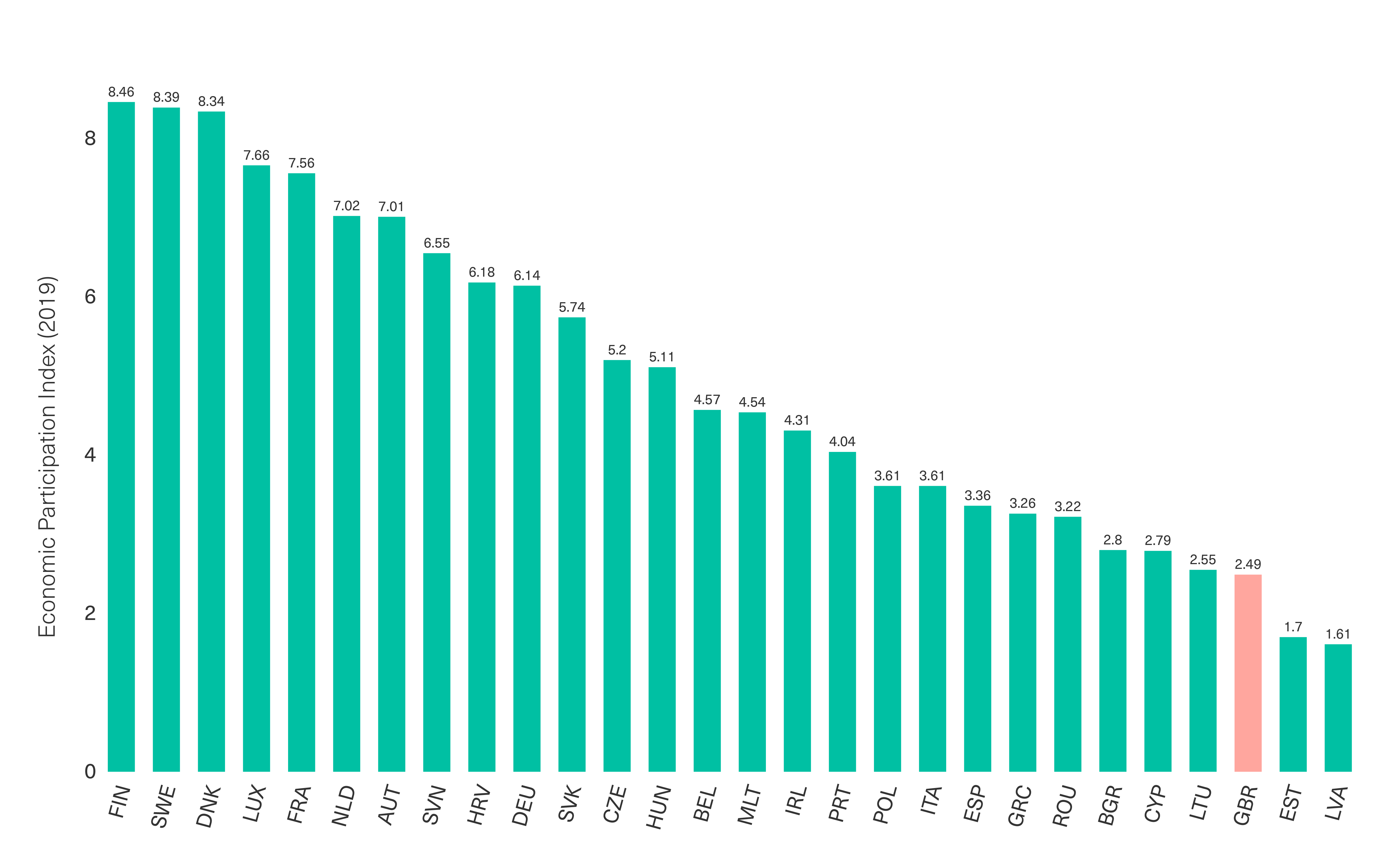

While it is more challenging to draw a direct correlation between business investment and economic participation in European countries, low levels of participation are correlated with lower levels of business investment in R&D, as illustrated by Figure 4. Countries with shareholder dominated corporate governance regimes encourage short-term company behaviour and a failure to invest in the research necessary to improve production. For example, analysis of firms listed on the Stockholm Stock Exchange between 2006 and 2014 showed that companies with employee representation were much less likely to make discretionary cuts to R&D when facing pressure on earnings. [20] R&D underperformance in the UK is significant: in 2020, business enterprise expenditure on R&D was 1.25 per cent of GDP, while the EU and OECD averages were 1.44 per cent and 1.92 per cent respectively. [21] The UK’s corporate governance system, its low levels of investment and its low investment in R&D are closely related, and help explain the country’s poor economic performance.

Productivity performance is tied to participation

Business investment is fundamental to productivity growth. [22] Shareholder primacy and the corporate behaviours it induces can thus help explain the UK’s weak productivity outcomes: businesses prioritise distribution over investment, dragging down aggregate performance. At the same time, companies in which workers have participation rights are often more productive overall; the lack of formal representation and a guaranteed stake and say is therefore a further headwind. [23] For instance, analysis of German firms with and without worker representation on supervisory boards demonstrated that companies with shared governance systems produced between two and eight per cent greater value add per worker. [24] Across European countries, the moderate correlation between performance in the EPI and productivity shown by Figure 5 offers support for this connection, although the political economic specificities of the post-Soviet and former Warsaw Pact states are likely a factor in the correlation. This connection between productivity and economic participation indicates that the fundamental structure of the company contributes to the stagnation of the UK and other low participation economies.

[.img-caption][.img-caption-header]Figure 5 European economies with low economic participation have low productivity rates[.img-caption-header][.img-caption-text]Source: OECD[.img-caption-text][.img-caption-text]Note: Malta and Cyprus have been excluded due to lack of data[.img-caption-text][.img-caption]

Inequality and participation

[.img-caption][.img-caption-header]Figure 6 Income inequality is concentrated in economies with low economic participation[.img-caption-header][.img-caption-text]Source: OECD[.img-caption-text][.img-caption-text]Note: Income Inequality data is taken from 2019, apart from in the cases of Ireland, Poland and Italy, where the latest available data is from 2018. Cyprus, Croatia and Malta have been excluded due to lack of data[.img-caption-text][.img-caption]

As Figure 6 highlights, economies that lack institutions of workplace participation also tend to be more unequal. The European countries with the weakest participation rights in terms of union density, bargaining, and governance have above average levels of income inequality, while the economies with strongest guaranteed rights have levels of income inequality below the European average. This follows logically: when workers have little to no say in company decision-making and lack strong collective bargaining power, it is unsurprising that this power imbalance leads to an upward redistribution of income to those whose interests are prioritised. Rewards at the very top of the income scale exemplify this dynamic: of eleven major EU economies (which represent 85 per cent of companies in the S&P Europe 350), UK CEOs receive the second highest total compensation. [25]

[.img-caption][.img-caption-header]Figure 7 Employee participation rights are associated with higher real wages[.img-caption-header][.img-caption-text]Source: OECD[.img-caption-text][.img-caption-text]Note: Bulgaria, Cyprus, Croatia, Malta and Romania have been excluded due to lack of data[.img-caption-text][.img-caption]

Nor do imbalances in power due to the absence of participation rights just generate inequality, as Figure 7 suggests, they are also associated with weak real wages overall. In the UK, real wages are on a trajectory of decline: labour compensation per hour worked fell by 2.9 per cent in 2021, whereas in the EU, it grew by 0.77 per cent on average. [26] Between 2007 and 2021, the UK was one of only seven countries in the OECD in which real wages fell and the outlook for workers between 2021-22 and 2023-24 is similarly grim: the Office for Budget Responsibility predict the sharpest fall in living standards since records began in the 1950s. [27]

Firm level data on the relation between wages and worker representation in Norwegian and German companies indicates that increased board representation alone has little effect on wages. [28] However, the same analysis shows that in Norway, firms with higher unionisation rates pay higher wages. [29] Evidence from across Europe supports this picture, showing higher wages associated with collective bargaining agreements. [30] This connection between wages and collective bargaining reflects the correlation between the UK’s recent real wage performance and its near-bottom position on the EPI (the latter of which accounts for trade union density and collective bargaining coverage). Put simply, collective bargaining boosts pay and reduces inequality; economies in which it is widespread and legally supported are more equal and enjoy stronger real wages. At the same time, when power is concentrated and company purpose narrowly defined to maximise shareholder wealth, the primary claim on a company’s surplus and strategic direction is to reward its external investors, instead of prioritising better work and higher wages. The result is weak real wage growth for ordinary workers in economies geared toward rewarding wealthy asset-owners.

Sketching an alternative

Corporate governance can sometimes seem a legalistic or abstract issue, distant from the concerns of everyday life. In practice, though often operating invisibly, the way corporations are governed decisively shapes how businesses operate, and therefore whether we live in an inclusive, dynamic and sustainable economy, or one — as at present — marked by stagnation and inequality. Reforming who has decision-making power within the company and its purpose is therefore critical to achieving the urgent changes necessary to ensure everyone has the opportunity to prosper: rising real wages built on strong productivity growth; decent and fulfilling work for all based on democratic production and non-exploitative relations; rising business investment to drive innovation and build the economy of the future, including just and rapid decarbonisation.

Achieving these goals will require a transition away from shareholder primacy to a democratic corporate governance model that gives real power to the varied stakeholders that make up the company. [31] Taken together, this new model of corporate governance should aim to rebalance and democratise distributional decision-making, with the goal of increasing investment and wages and supporting innovation in production. A democratic model can also embed climate safeguards, such as a green veto power, within corporate decision making to ensure that production is compatible with rapid decarbonisation — an approach connected to the inclusion of a broader range of stakeholders, with wider interests than shareholders. Specifically, by reorienting fiduciary duties away from maximising shareholder value and toward serving the interests of multiple stakeholder groups; by including workers in the governance of their workplace through employee representation on boards and in company membership; through the reintroduction of sectoral collective bargaining and union representation; through new institutions to guarantee employees share fairly in the profits they create; and through innovative action to decarbonise business activity, an ambitious reform agenda can transform the British economy away from stagnation and exclusion to a sustainable, dynamic and inclusive future.

Some might object that reform of company law would mark a shift to an “interventionist” agenda; however, this claim misunderstands the nature of the corporate form. Public power is already fundamental to constituting the modern corporation and how it is governed. The state grants companies extraordinary legal privileges as a benefit of their incorporation, including the rights to perpetual existence, limited liability and the ability to take out debt in the corporate name. These legal privileges — which, for instance, protect the future losses of shareholders if the company fails without protecting workers — should underpin a reciprocal relationship: in return for rights granted by the public, the corporate form should act as a vehicle for collective and shared prosperity rather than an engine of wealth extraction. The task is to rewrite the rules of the company to unlock the benefits of genuinely democratic, inclusive and thriving enterprise.